Friday, December 26, 2025

Happy Friday everyone!

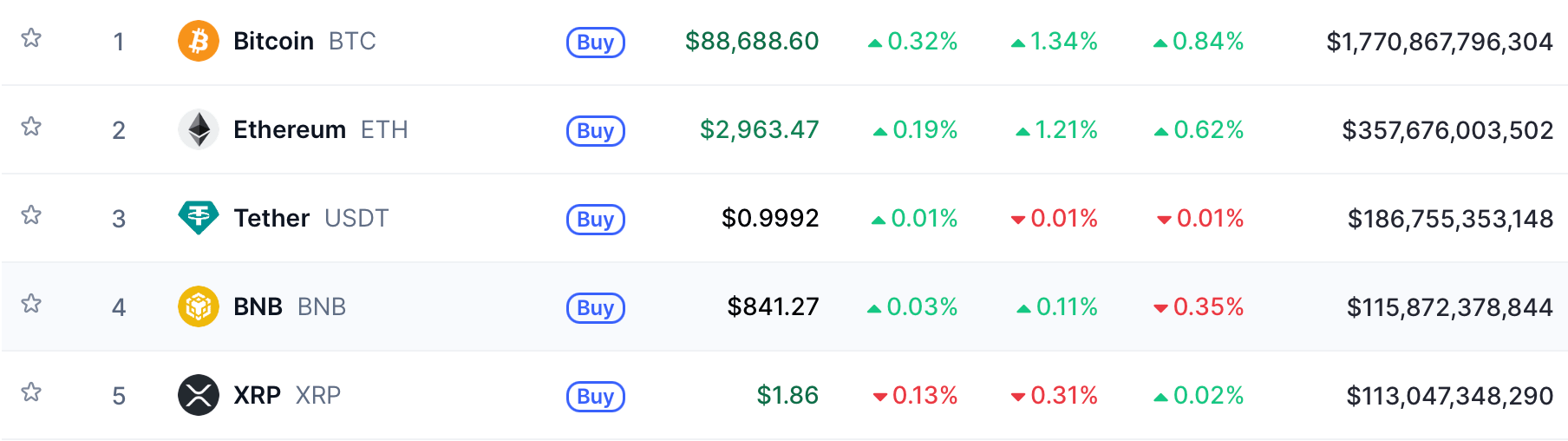

Crypto markets closed the year at a crossroads, balancing security challenges, infrastructure expansion, and long-term conviction. Trust Wallet moved quickly to contain a $7 million breach tied to a compromised browser extension, pledging full reimbursement as scrutiny intensifies around wallet security. At the same time, prediction market platform Kalshi, co-founded by Lebanese Tarek Mansour, expanded its onchain footprint by integrating BNB Smart Chain, opening new liquidity pathways for users globally. Meanwhile, Strategy CEO Phong Le argued that Bitcoin’s fundamentals remain stronger than ever despite a late-2025 price slump, pointing to growing institutional and government alignment as a long-term tailwind for the asset.

Trust Wallet Breach Drains $7 Million As Binance-Owned Wallet Promises Full Refunds

📰 What is it about?

Trust Wallet, a non-custodial crypto wallet owned by Binance, suffered a security breach on Christmas Day 2025 after malicious code was introduced into its Chrome extension version 2.68. The flaw allowed attackers to steal seed phrases, draining around $7 million in crypto from hundreds of users across Bitcoin, Ethereum, and Solana. Mobile app users and other versions were not affected.

💡 Why it matters?

The incident highlights growing risks around browser wallet extensions and software supply-chain attacks in crypto. Trust Wallet, founded in 2017 and acquired by Binance in 2018, is one of the world’s most widely used self-custody wallets. Any breach undermines confidence in Web3 security, even as Binance co-founder Changpeng Zhao reassured users that all losses will be fully reimbursed.

🔜 What’s next?

Trust Wallet has patched the issue with version 2.69, urged users to update immediately, and revoke suspicious permissions. The company is still investigating how the malicious update passed review, raising questions about internal controls and extension store security. The incident is likely to increase scrutiny on wallet providers and accelerate calls for stronger safeguards around browser-based crypto tools.

Kalshi Adds BNB Smart Chain Support To Expand Onchain Access To Prediction Markets

📰 What is it about?

Prediction market platform Kalshi has integrated BNB Smart Chain, allowing users to deposit and withdraw BNB and major stablecoins directly on BSC. The move enables both US and international users to trade real-world event outcomes using assets already held within the BSC ecosystem.

💡 Why it matters?

The integration removes friction from cross-chain bridging and network switching, opening Kalshi’s high-liquidity prediction markets to one of the world’s largest blockchain communities. It highlights growing convergence between regulated market platforms and public blockchains, broadening access to onchain financial products.

🔜 What’s next?

Kalshi says the BSC rollout is part of a broader omni-chain strategy aimed at supporting multiple blockchains and assets. As more networks are added, the platform is positioning itself to become a global, chain-agnostic gateway for prediction markets tied to real-world events.

Bitcoin Fundamentals Strong Despite Late-2025 Price Slump, Says Strategy CEO

📰 What is it about?

Strategy CEO Phong Le says Bitcoin’s underlying fundamentals remain strong in 2025 despite a sharp price pullback and worsening market sentiment. Speaking on the Coin Stories podcast, Le downplayed short-term volatility, stressing that long-term adoption and structural trends matter far more than near-term price movements.

💡 Why it matters?

Bitcoin has fallen nearly 30% from its October all-time high while market sentiment sits in “Extreme Fear.” Yet Le points to growing institutional and government support, particularly in the US, as evidence that Bitcoin’s long-term investment case remains intact despite declining prices and Strategy’s mNAV falling below one.

🔜 What’s next?

Le says traditional banks in the US and UAE are actively trying to catch up to Bitcoin adoption, signaling deeper integration ahead. Strategy plans to stay methodical, focusing on Bitcoin and dollar treasuries as institutions increasingly align with crypto amid shifting global financial dynamics.