Friday, January 2, 2026

Happy Friday everyone!

Cryptocurrency's dual nature as both financial innovation and geopolitical tool came into sharp focus this week. Former Binance CEO CZ Zhao and MicroStrategy's Michael Saylor lost billions as Bitcoin tumbled from its $126,000 October peak, highlighting the volatility still plaguing digital assets. Meanwhile, regulatory frameworks tighten globally, the UAE joins 26 countries preparing to exchange crypto tax data by 2028 under the OECD's transparency initiative. On the other hand, Iran's defense ministry now reportedly accepts cryptocurrency for ballistic missiles and drones, exploring digital alternatives to evade Western sanctions.

CZ And Crypto Executives Lose Billions In 2025 Market Turmoil

📰 What is it about?

Former Binance CEO Changpeng "CZ" Zhao, who lives in the UAE now, MicroStrategy's Michael Saylor, and the Winklevoss twins suffered major losses in 2025. Saylor lost $2.6 billion, while the Winklevosses saw their wealth drop 59%. An October flash crash triggered Bitcoin's fall from $126,000 to $80,000.

💡 Why it matters?

The losses highlight cryptocurrency's volatility despite mainstream adoption. While some executives prospered—Circle's Jeremy Allaire gained 149%—the crash exposed risks in corporate Bitcoin treasury strategies that drove MicroStrategy's stock down over 50%.

🔜 What’s next?

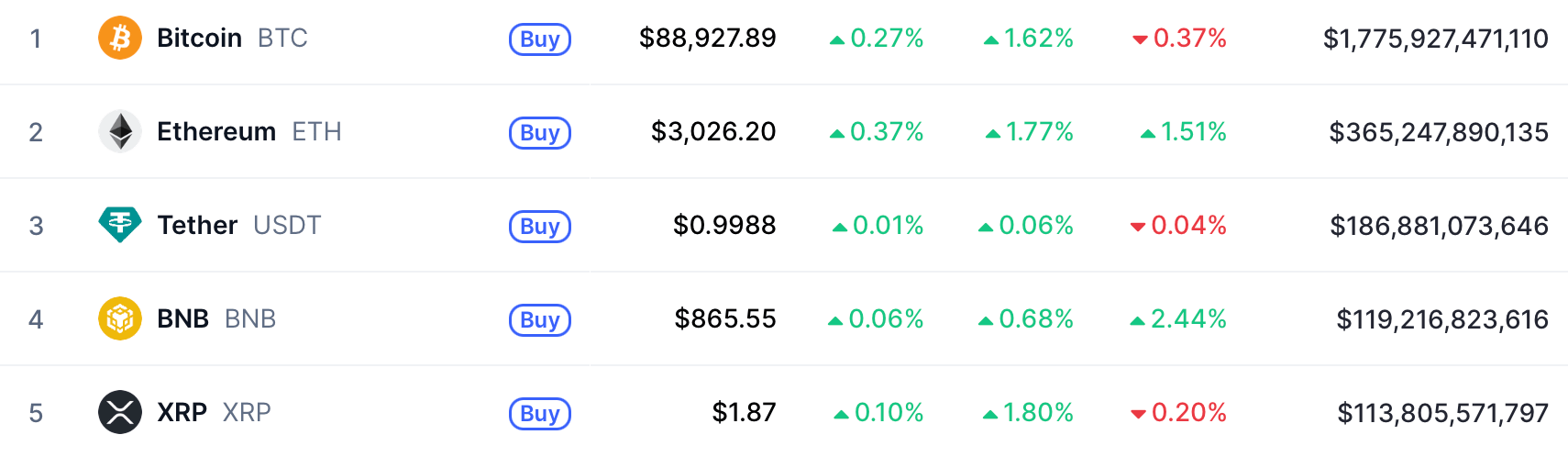

Nearly 200 public companies now hold Bitcoin on their balance sheets, signaling continued institutional interest. Bitcoin trades around $89,000, down 7% year-to-date, as markets await regulatory clarity following the GENIUS Act's passage.

UAE Among 27 Jurisdictions Set To Launch Crypto Tax Data Exchanges By 2028

📰 What is it about?

The United Arab Emirates joins 26 other countries beginning crypto transaction data collection in 2027 for tax exchanges starting in 2028. Meanwhile, 48 jurisdictions including Japan, UK, and South Korea already started recording crypto wallet data this January under the OECD's Crypto-Asset Reporting Framework.

💡 Why it matters?

Crypto exchanges, ATMs, and brokers must now track customer transactions and share them with tax authorities globally. This means governments can see crypto activities across borders, making it harder to hide assets or evade taxes, fundamentally changing crypto's privacy landscape.

🔜 What’s next?

By 2028, 75 countries will exchange crypto tax data internationally. Authorities may use this information beyond taxation—potentially identifying anonymous wallet holders and tracking criminal activity, according to crypto tax experts.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Iran Reportedly Offers Ballistic Missiles And Drones For Cryptocurrency Payment

📰 What is it about?

Iran's Ministry of Defence Export Center is selling advanced weapons, including Emad ballistic missiles, Shahed drones, and warships, for cryptocurrency payments, the Financial Times reported. The pitch targets 35 countries through a multilingual website featuring a virtual chatbot that addresses sanctions concerns, marking a rare public case of state-level crypto arms deals.

💡 Why it matters?

Cryptocurrency enables Iran to bypass Western banking sanctions and continue military exports despite financial restrictions. This trend poses enforcement challenges as sanctioned nations increasingly use digital currencies to sustain weapons trade outside traditional financial systems that authorities can monitor and control.

🔜 What’s next?

Iran's arms push intensifies as Russia's weapons exports plummeted 64% since 2020 due to the Ukraine war. US Treasury officials are escalating sanctions against crypto-linked networks supporting Iran's military, while experts warn Tehran could replace Russia as a leading arms supplier.

🔎 From the World of Crypto

Vitalik Buterin on the two goals Ethereum must meet to become the ‘world computer’

Trump Media to distribute new digital tokens to DJT shareholders

Strategy reloads on bitcoin, acquires a further 1,229 BTC for $109 million