Monday, January 5, 2026

Happy Monday everyone!

The crypto world kicks off 2026 with intriguing developments across regulation, innovation, and market sentiment. A Muslim trader's call for halal perpetual exchanges has ignited debate about faith-based DeFi, highlighting the untapped $3 trillion Islamic finance market. Meanwhile, Saudi Arabia's capital market chief revealed plans to license Bitcoin, but only as a store of value, not for payments, potentially opening the kingdom's massive sovereign wealth to crypto. On the sentiment front, social chatter turned surprisingly positive despite fear indicators, with analysts warning that sustained gains depend on retail traders staying level-headed.

Muslim Trader Calls For Sharia-Compliant Crypto Exchange, Sparking Debate On Faith-Based DeFi

📰 What is it about?

Crypto trader Abbas Khan proposed building a halal perpetual decentralized exchange after witnessing strong demand from Muslim users. Traditional perp DEXs like Hyperliquid use leverage, margin trading, and funding rates, all prohibited under Islamic law as riba, gharar, and maysir.

💡 Why it matters?

The $3 trillion Islamic finance market remains largely excluded from DeFi opportunities. Muslim traders face a stark choice between violating religious principles or missing lucrative trading mechanisms. This gap represents both an underserved community and significant untapped market potential for Sharia-compliant blockchain innovation.

🔜 What’s next?

Developers are exploring alternatives like asset-owned leverage and spot-backed synthetic products that could maintain trading functionality without prohibited elements. The challenge remains creating profitable, competitive products without leverage or funding rates, potentially redefining what decentralized trading looks like for faith-conscious investors.

Saudi Capital Market Chief Says Kingdom May License Bitcoin As Store Of Value, Not Payment

📰 What is it about?

Mohammed bin Abdullah Elkuwaiz, chairman of Saudi Arabia's Capital Market Authority, announced at the Financial Sector Conference 2025 that the kingdom is exploring Bitcoin licensing for trading and store-of-value purposes. However, Saudi Arabia explicitly rejects Bitcoin as a payment method, seeking to delink it entirely from payment infrastructure.

💡 Why it matters?

This marks a potential major shift in one of the world's wealthiest nations toward crypto adoption while maintaining strict monetary control. Saudi Arabia's $925 billion sovereign wealth fund entering Bitcoin markets could trigger massive institutional investment flows. The store-of-value-only approach offers a regulatory blueprint for conservative Gulf states balancing innovation with financial stability.

🔜 What’s next?

The timeline for aggressive licensing hinges on successfully separating Bitcoin from payment rails, likely requiring new regulatory frameworks and custody solutions. If implemented, Saudi Arabia could join UAE and Bahrain in Middle Eastern crypto leadership, potentially catalyzing similar policies across GCC nations and attracting major exchanges to establish regional operations.

Crypto Social Chatter Has 'Very Positive' Start To 2026: Santiment Analyst Warns Of FOMO Risk

📰 What is it about?

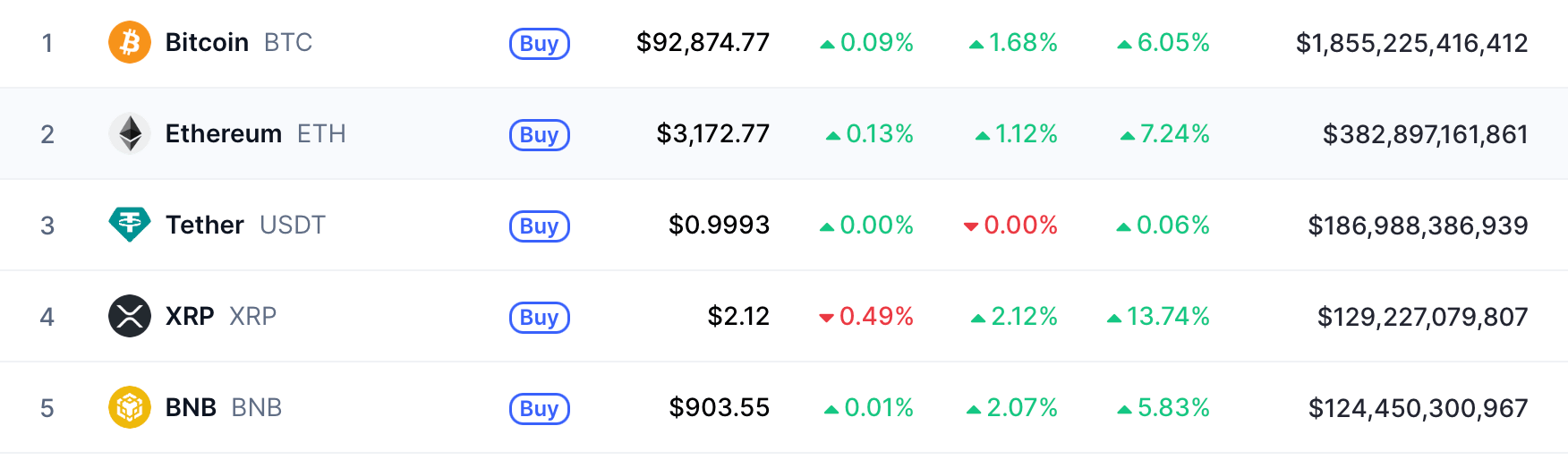

Santiment analyst Brian Quinlivan reports surprisingly positive social media sentiment among crypto traders entering 2026, contrasting with the Crypto Fear & Greed Index's "Fear" reading of 29. He cautioned that continued market upside requires retail investors maintaining caution rather than succumbing to FOMO, particularly if Bitcoin rapidly approaches $92,000.

💡 Why it matters?

Historically, excessive retail optimism signals market tops, while cautious sentiment supports rallies. The divergence between positive social chatter and fear indicators creates uncertainty about true market direction. January typically delivers strong returns, 3.75% for Bitcoin and 19.07% for Ethereum since 2013, making early sentiment critical for predicting 2026's trajectory.

🔜 What’s next?

Bitcoin's movement toward $92,000 will test retail psychology and reveal whether investors flood in with FOMO-driven capital. Quinlivan suggests sustained gains require traders staying "cautious, pessimistic, and impatient" rather than euphoric. If retail sentiment shifts to extreme greed while Bitcoin rallies, historical patterns suggest a potential correction could follow.

🔎 From the World of Crypto

Visa crypto card spending soars 525% in 2025

Vitalik Buterin on the two goals Ethereum must meet to become the ‘world computer’

Trump Media to distribute new digital tokens to DJT shareholders

Strategy reloads on bitcoin, acquires a further 1,229 BTC for $109 million